Reporting

This guide provides an overview on the standard reports and analytics

Report sections

The reporting area of the Spreedly application will provide the following sections for specific reporting areas, with each being filtered to your selected Environment:

- Environment activity

- Success Rates

- Failure rates

- Transactions

- Recover

- 3DS2

- Payment Methods

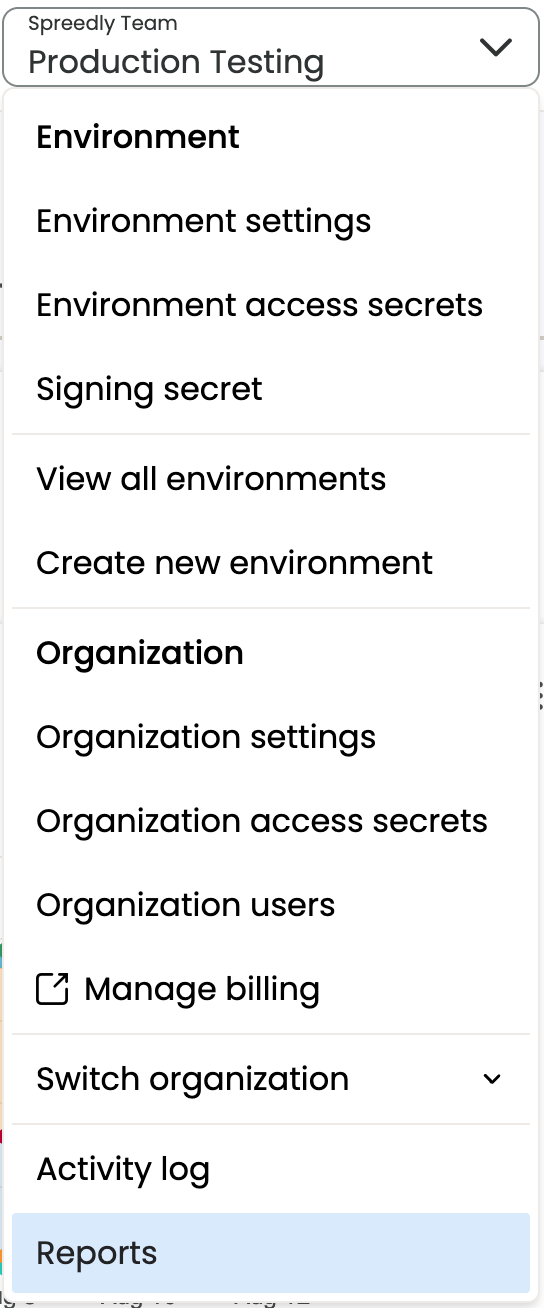

Users can review these same tables and visualizations combining all data across every environment in the organization by accessing the Reports section of the Organization menu.

Environment Activity

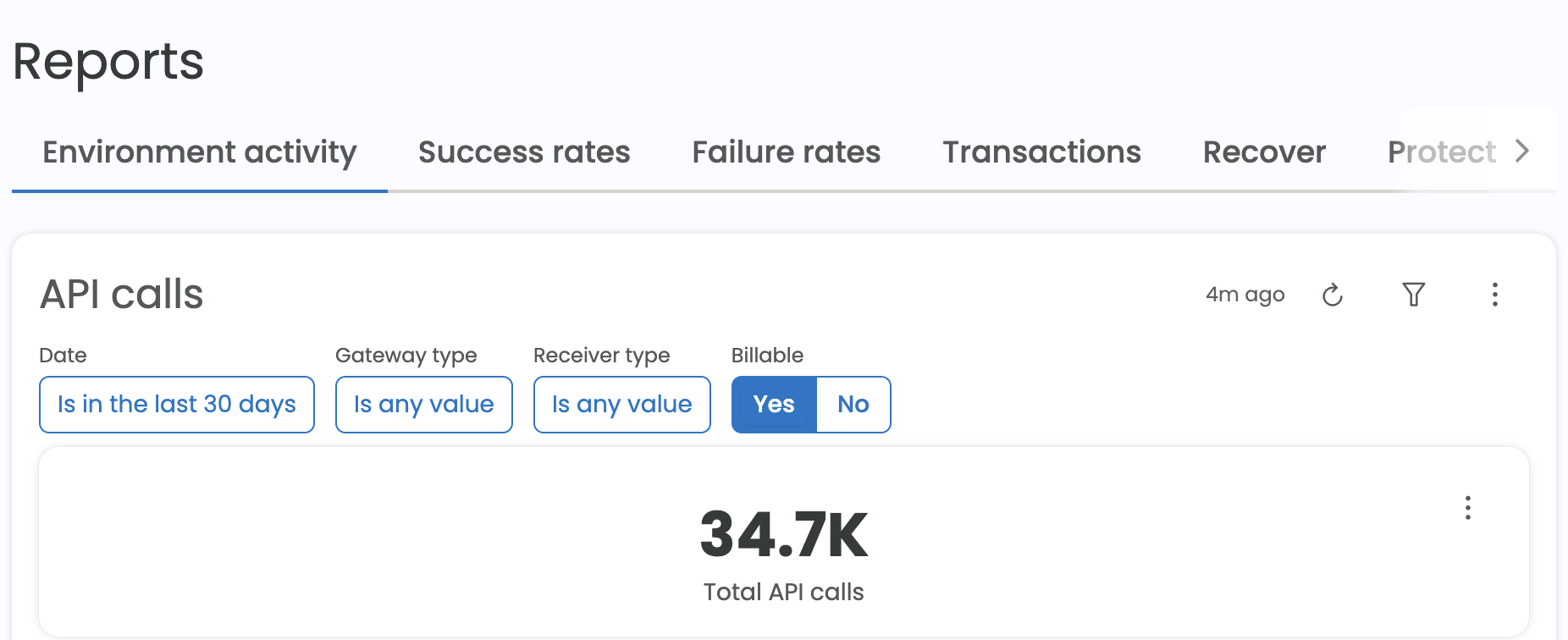

The Environment activity landing page provides a quick snapshot of overall payment performance. One can look at transaction trends, key data points and recent transactions on this page.

Filters

Environment activity reports include filters for date, gateway type, receiver type, and billable activity. The date filter offers multiple control conditions to index recent API calls in an environment. The gateway and receiver filters can be used include or omit a given PSP from the report. The billable toggle will filter out process-oriented calls applicable only to Spreedly Advanced Vault customers, including update_gratis, card_refresher inquiries and some Network token activity. Spreedly does not differentiate between test and production activity for billing purposes.

Once any filter is updated, select the refresh icon in the top right of the report to refresh the data with filters applied.

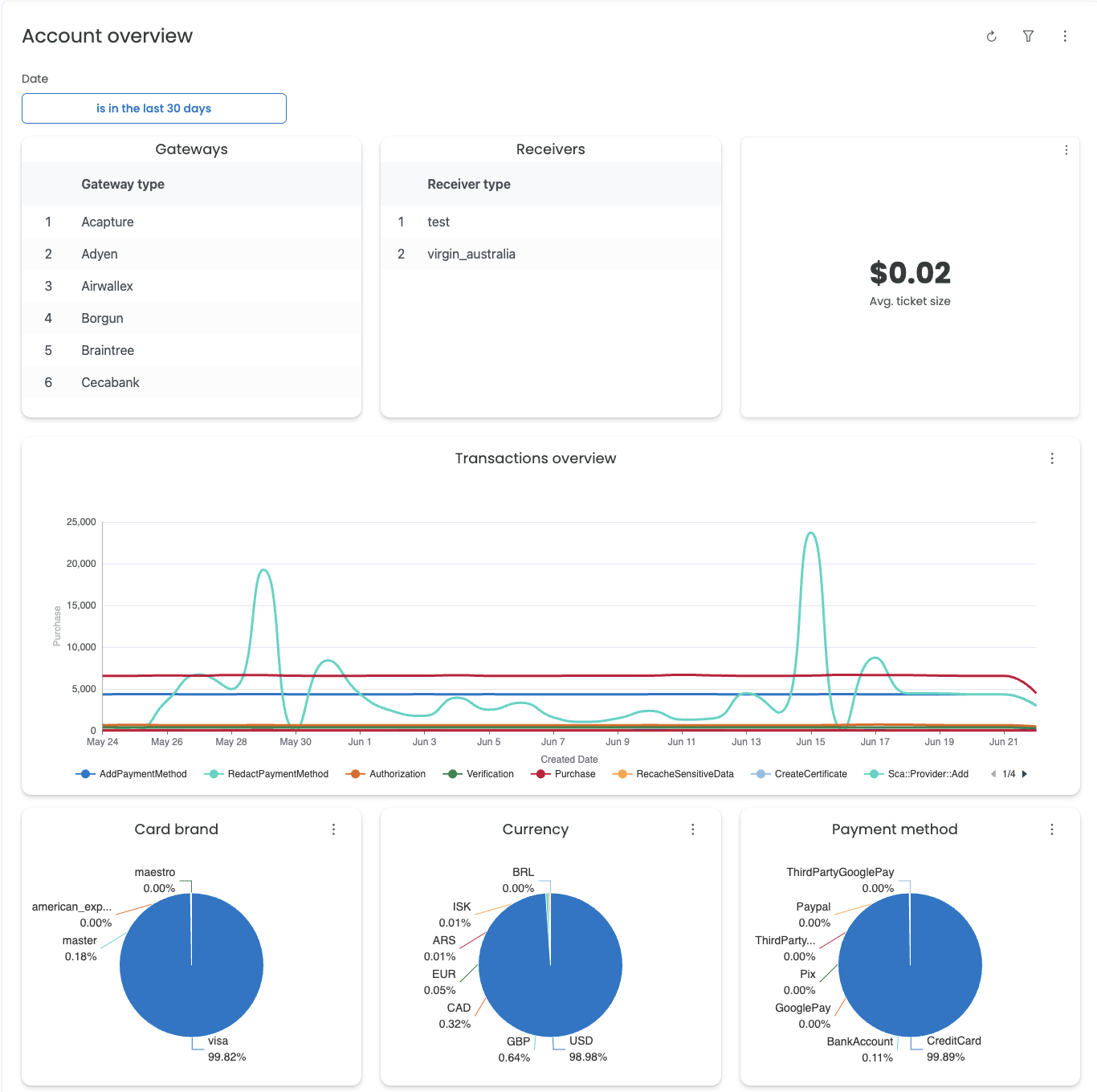

The following is a snapshot of the data points available on this landing page. Based on the Date and Environment you have selected in the application, a user can look at the following data:

- Gateways:: List of all gateways that had transactions

- Receivers: List of all receivers that had transactions

- Avg Tkt Size: Avg $ value of all successful

Purchase, Capture, PurchaseViaReference, OffsitePurchasetransactions on non-test gateways - Transactions: Trend of all transactions by count

- Card Brand: % Split of payment method card brand

- Currency: % Split of currencies used in transactions

- Payment Method: % Split of payment method type

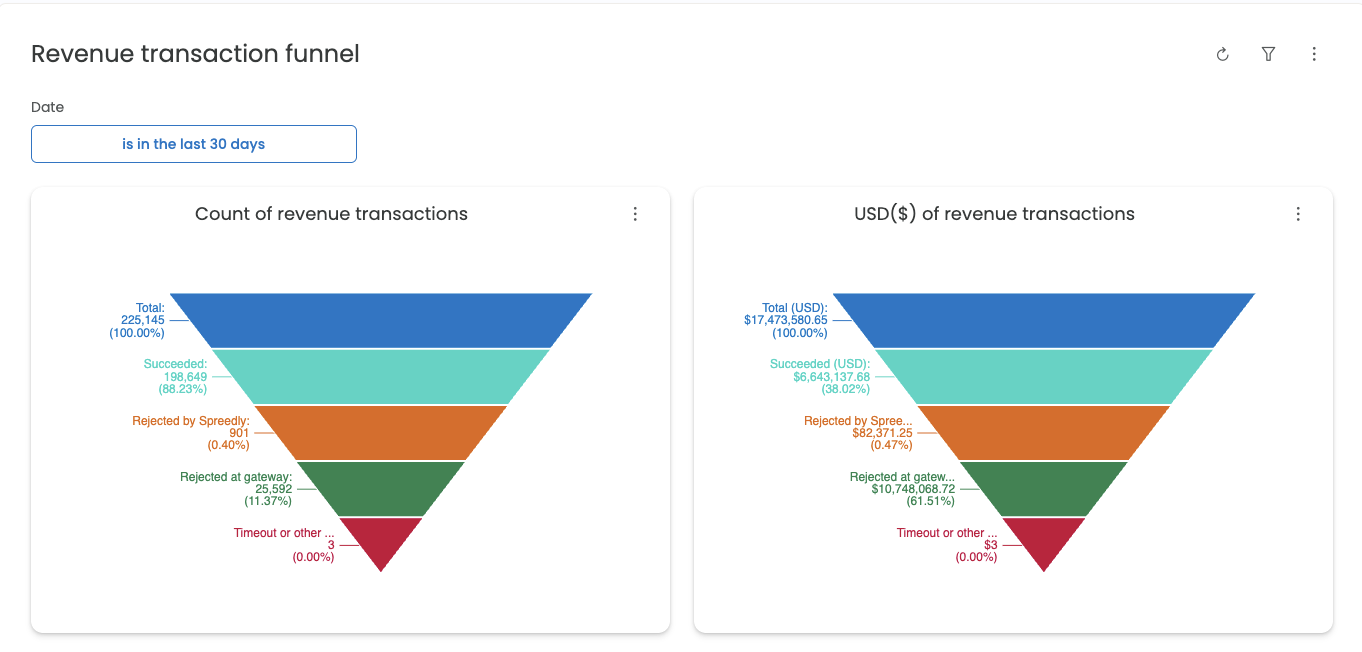

The following funnel view provides a snapshot of the number of transactions and their US Dollar value.

- Count: Funnel view of the # of transactions (

Authorization, Capture, Purchase, Verification, Credit, Void, Store, GeneralCredit, OffsiteAuthorizationandOffsitePurchase) grouped by the transaction state:succeeded, failed, gateway_processing_failedandgateway_processing_result_unknown - USD: Funnel view of the USD amount of transactions (

Authorization, Capture, Purchase, Verification, Credit, Void, Store, GeneralCredit, OffsiteAuthorizationandOffsitePurchase) grouped by the transaction state:succeeded, failed, gateway_processing_failedandgateway_processing_result_unknown

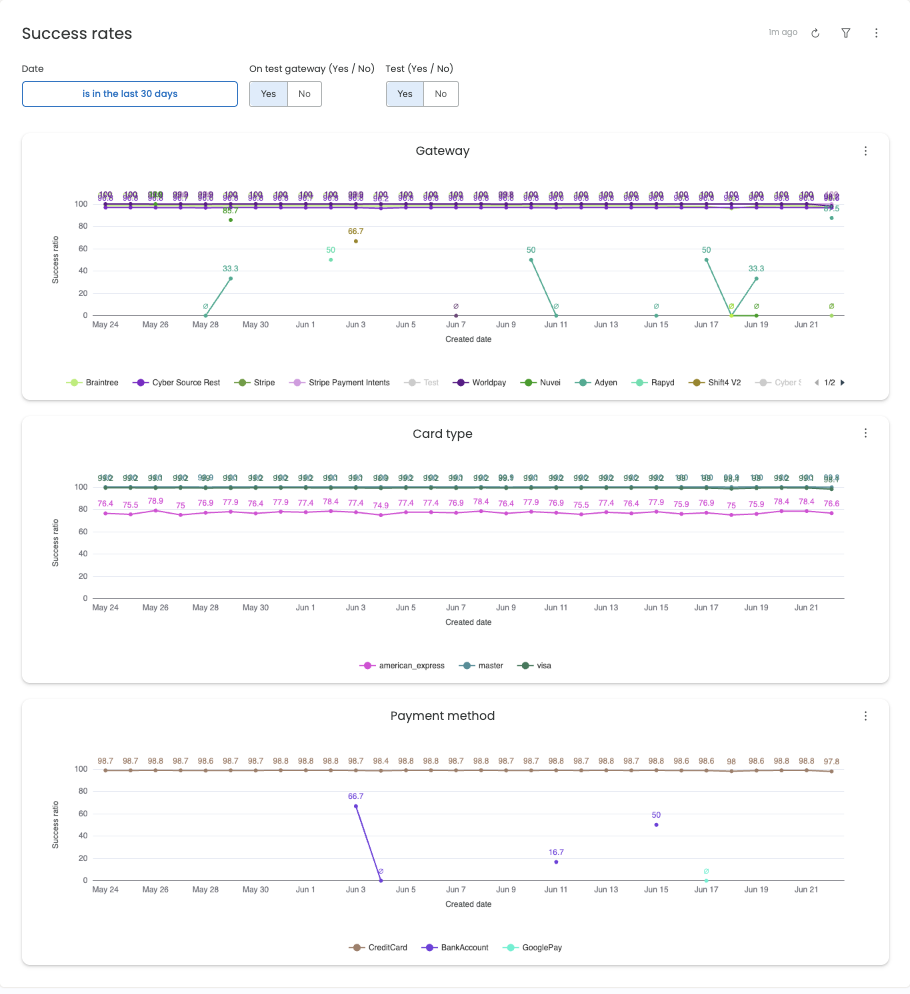

Success rates

The Success rates section provides insights into success rates on various dimensions:

Payment method: Success % trend by payment method Card brand: Success % trend by card brand Gateway: Success % trend by gateway

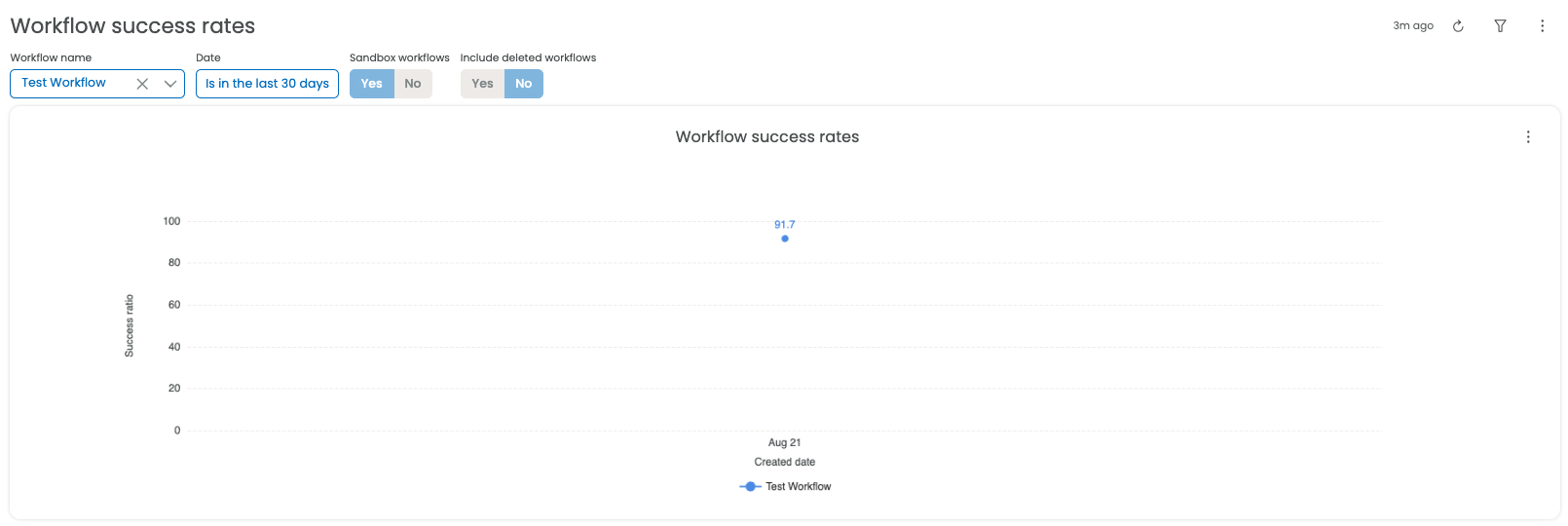

The Workflow success rates section provides insights into success rates on:

Workflow: Success % trend by all workflows in the current environment Workflow version: Success % trend by version for a single workflow

View Composer documentation here to learn more about workflows

Success % = (# of Succeeded Purchase, Verification, Authorization, PurchaseViaReference, OffsitePurchase) / (All Purchase, Verification, Authorization, PurchaseViaReference, OffsitePurchase)

(Where transactions are neither test nor on a test gateway)

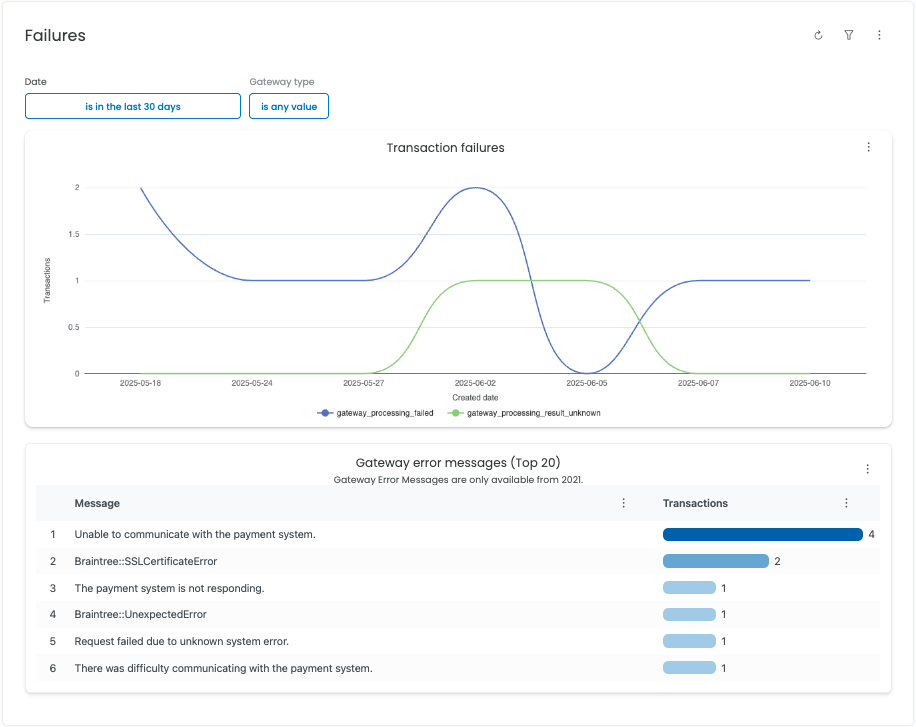

Failures

The Failures section provides insights into failure trends.

- Transaction failures: Trend of the # of

failed, gateway_processing_failedandgateway_processing_result_unknowntransactions - Gateway error messages: Top 20 most common gateway error messages on failed transactions under the selected Organization

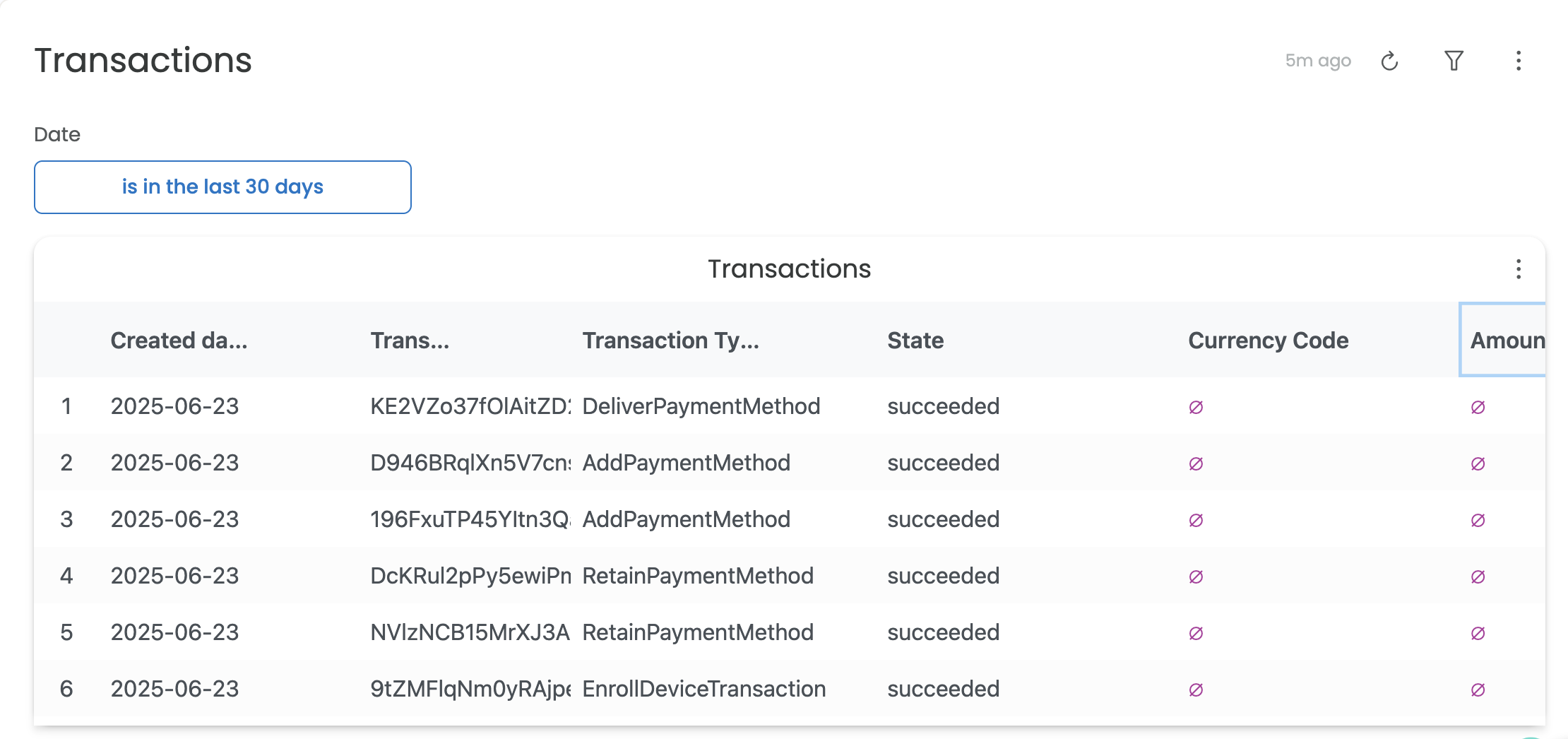

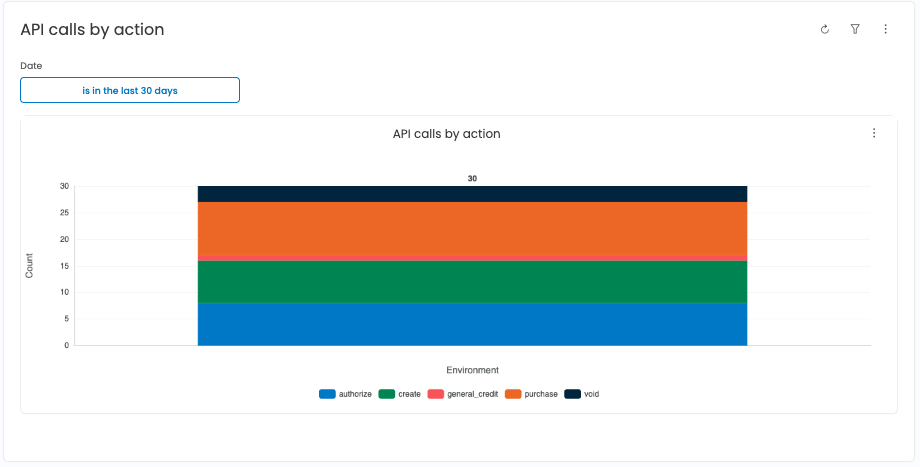

Transactions

The Transactions section can be used to retrieve all transactions within a given date range, as well as the API calls by environment

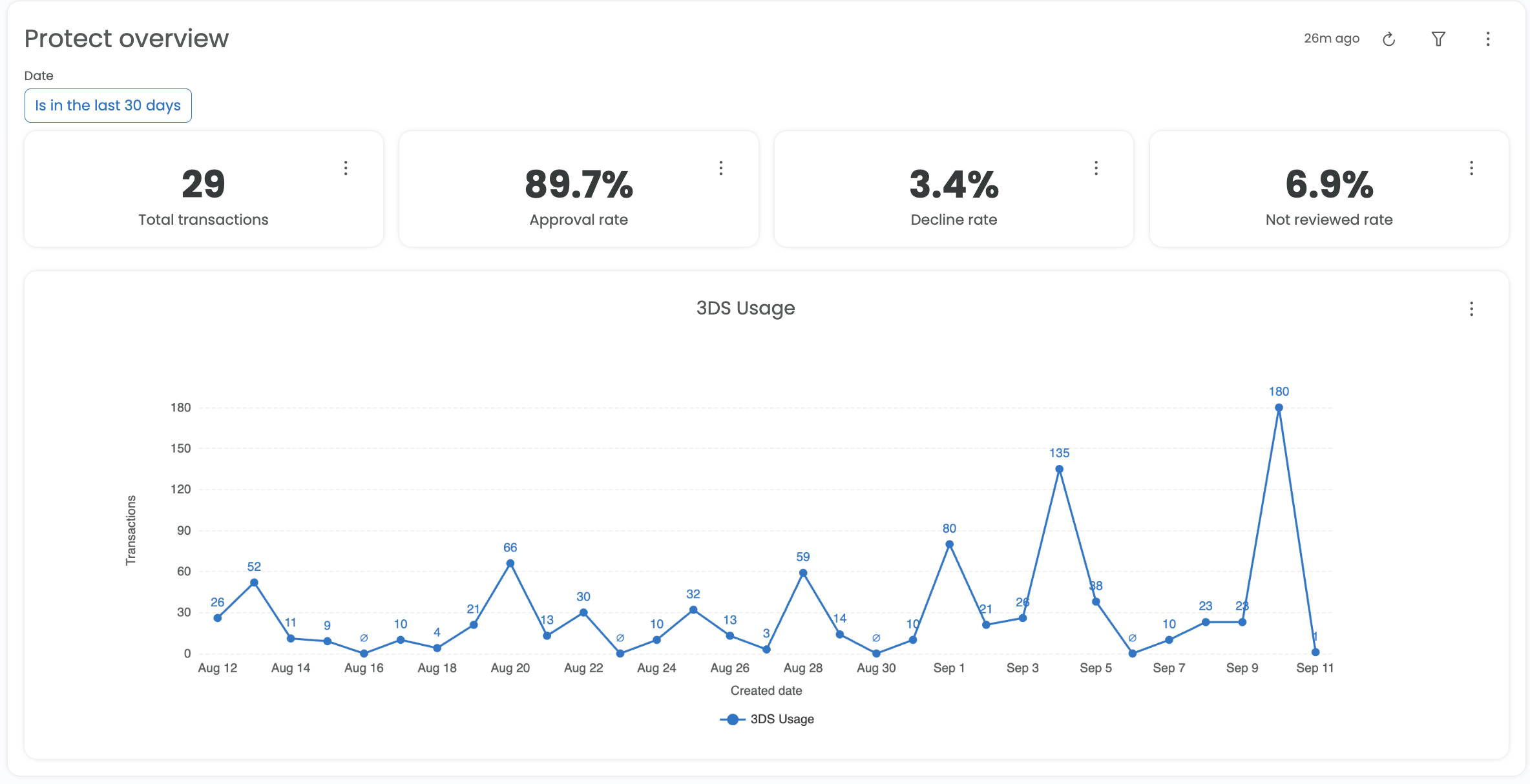

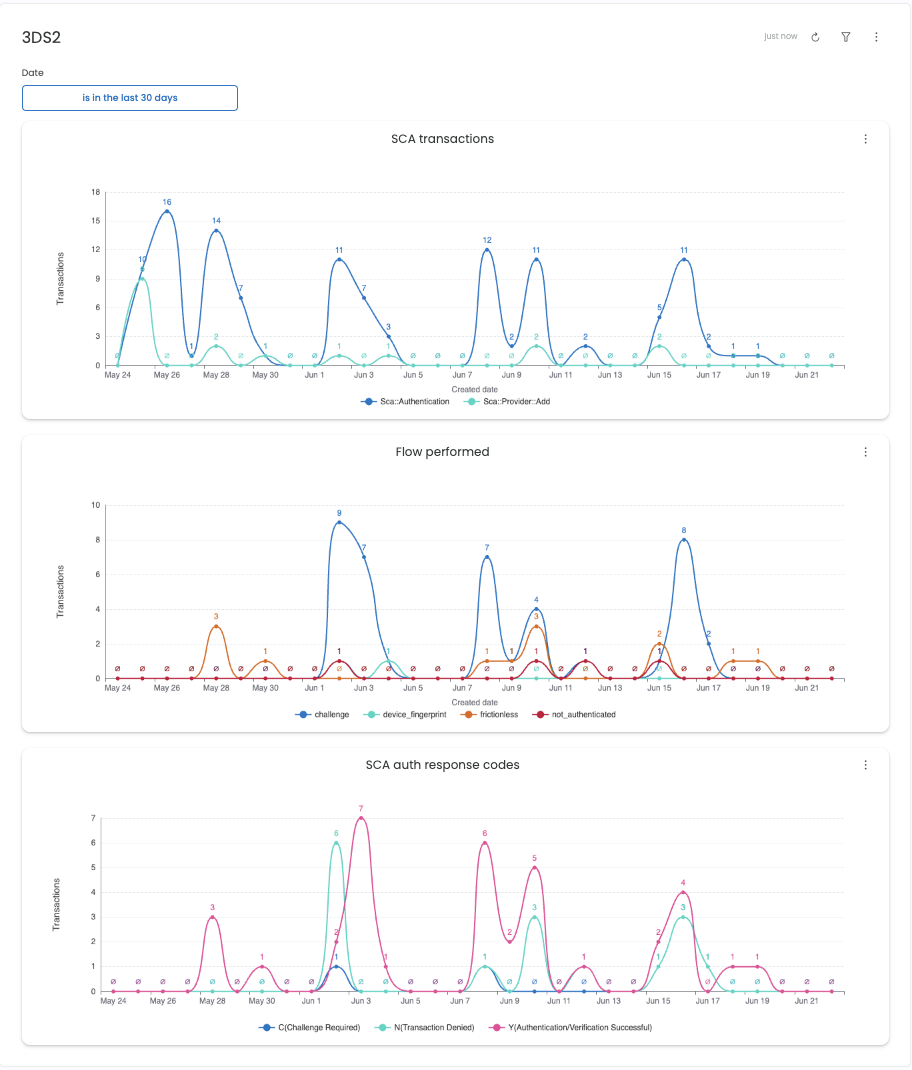

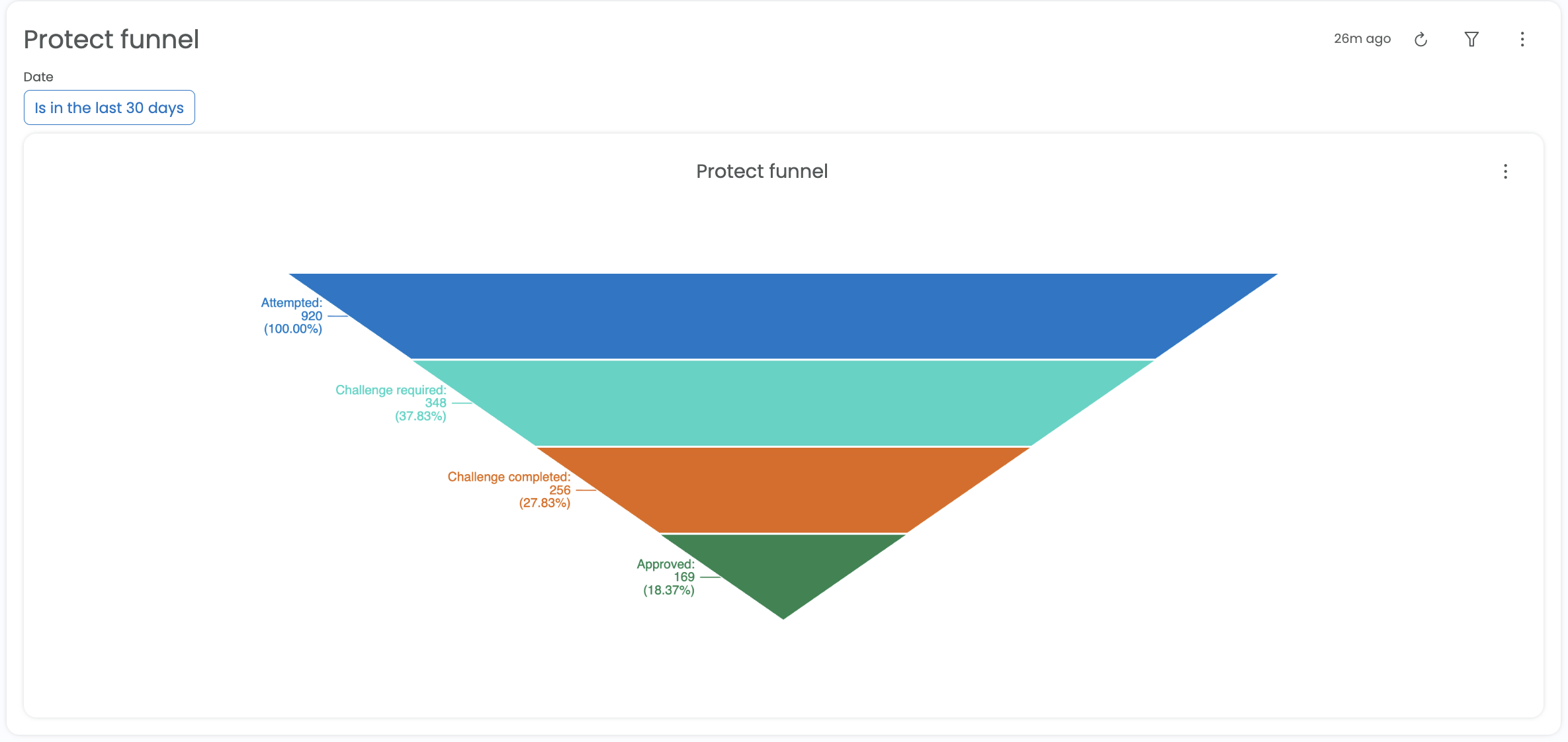

Protect

The Protect section provides insights into Spreedly's payment security features such as 3DS2 and Fraud management.

- Protect Overview: Summary of overall payment security

- Protect Funnel: Trend of Protect transactions flow(

attempted, challenge required, etc) - SCA transactions: Trend of SCA transactions

- Flow performed: Trend of transaction flow performed (

challenge, frictionless,etc. ) - SCA auth response codes: Trend of SCA authentication response codes

- Normalized decline reason: Pattern of failed transactions

- Fraud decisions: This report tracks fraud decision trends (

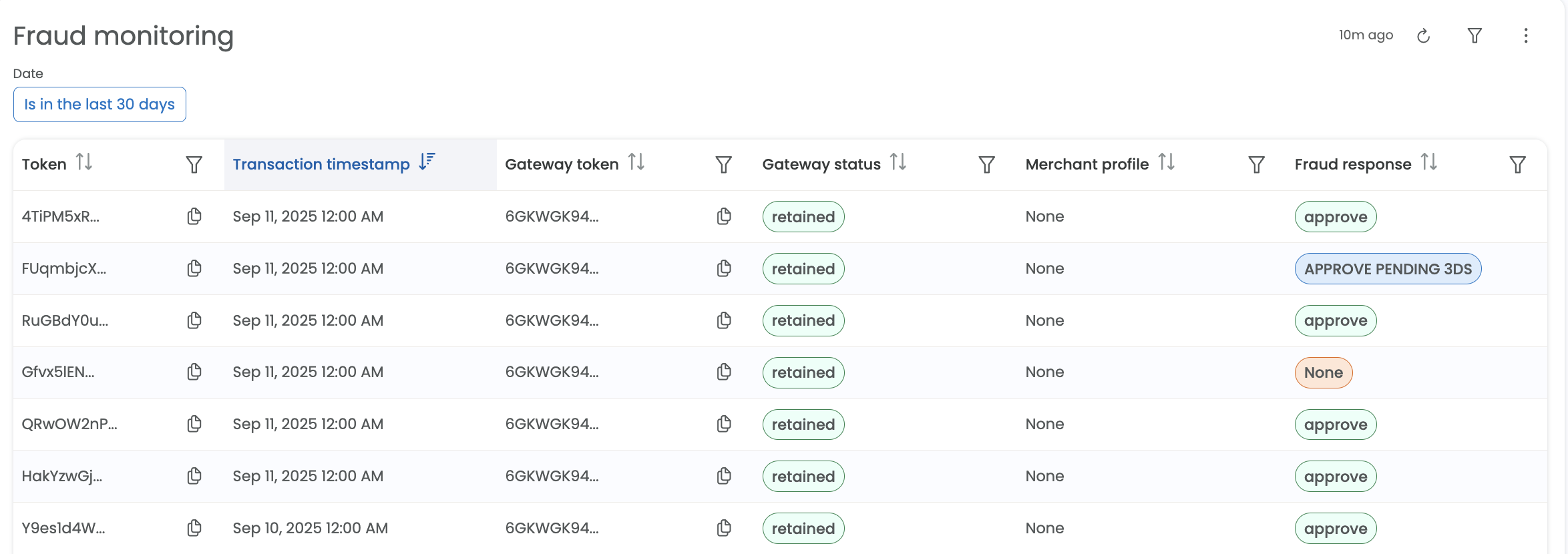

approved, declined, or not reviewed) - Fraud monitoring: This report provides a view of recent transactions, highlighting their gateway status and fraud response decisions (approve, pending 3DS, or none).

Payment methods

The Payment methods section provides insights into the customer’s payment method details.

- Retained payment methods: The trend of retained payment methods over time

- Payment methods by card type and brand: View the number of payment methods by card type and card brand

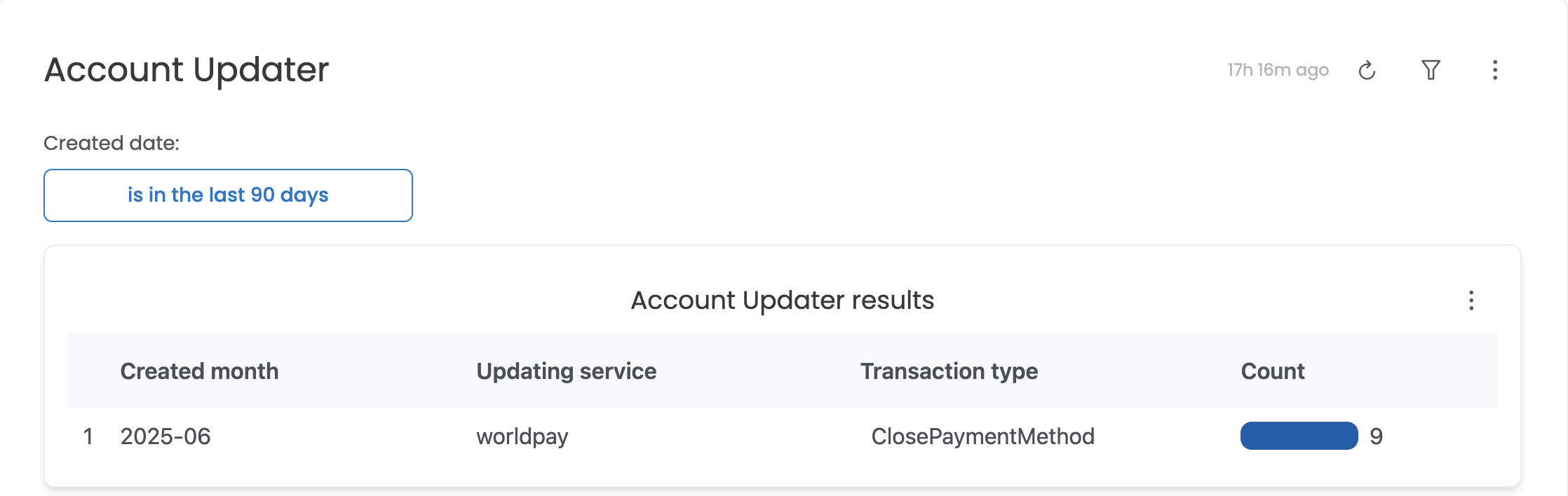

Lifecycle Management

If Lifecycle Management is enabled, users will be able to see the results from the latest update runs on this page. To learn more about how to keep your Payment Methods updated, visit the Lifecycle Management page.

Lifecycle Management runs and filters

The first report seen within the Account Updater section is a summary of runs by month, including details on the the count of each of the following transaction types:

- ReplacePaymentMethod - The number and/or expiration date has been updated.

- InvalidReplacePaymentMethod - We received either a new card number or expiration date that was invalid. The payment method was not updated, and there is no charge.

- ContactCardHolder - Contact the cardholder for a new number and/or expiration date. This status is a flag, so no changes are made to the payment method.

- ClosePaymentMethod - The account is no longer open and should no longer be used. The payment method will remain available, but Spreedly’s Lifecycle Management will no longer attempt to update it.

Additionally, the Total column will show all transactions and the Billable Total column will show all billable transactions (excluding InvalidReplacePaymentMethod)

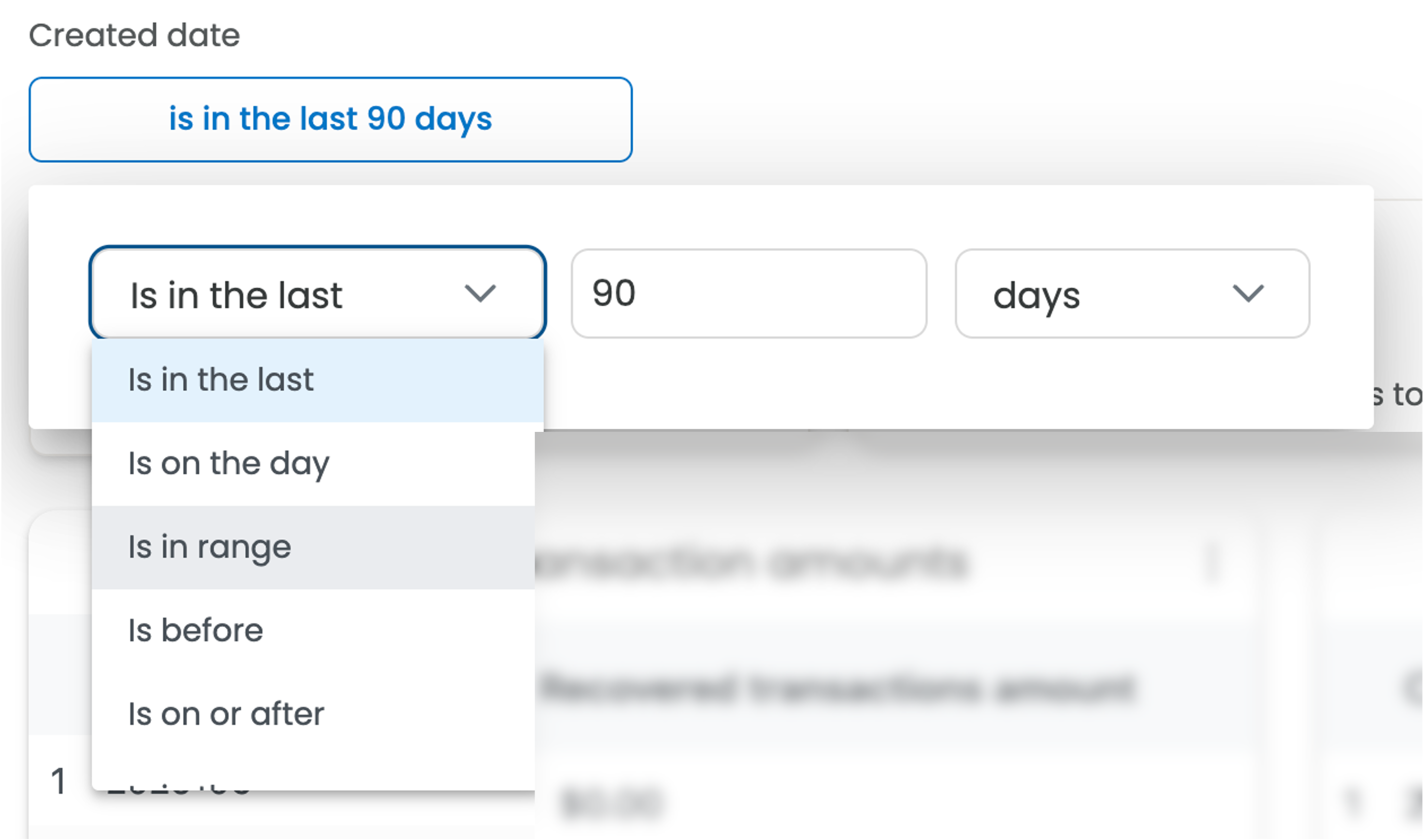

The Created Date filter at the top will allow you to select a specific range of dates to view Lifecycle Management runs, up to a limit of 12 months of history:

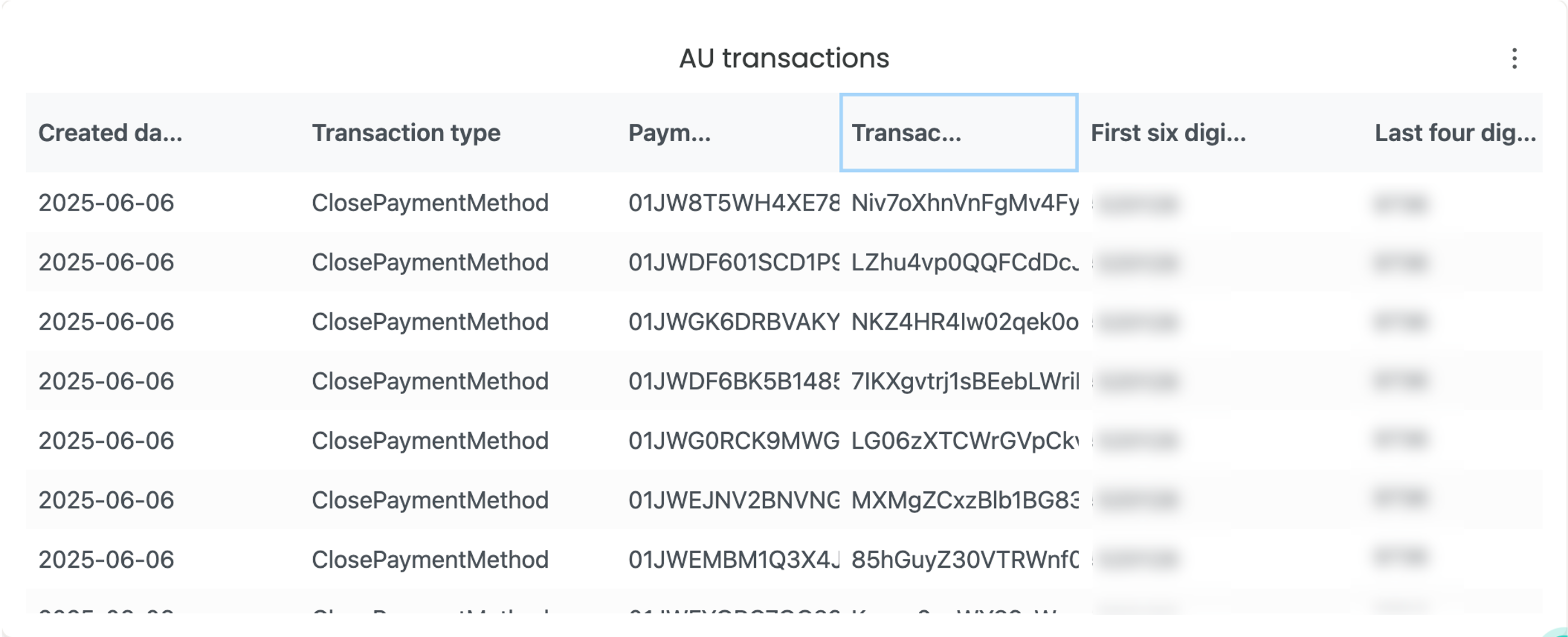

AU Transactions table

Below the updater runs summary is a table containing all transactions for your selected date range (as set by the Created Date filter noted above) including created date, payment method key, transaction token/ID/key, transaction type and card details including first six digits, last four digits, expiration month, and expiration year:

Additional data

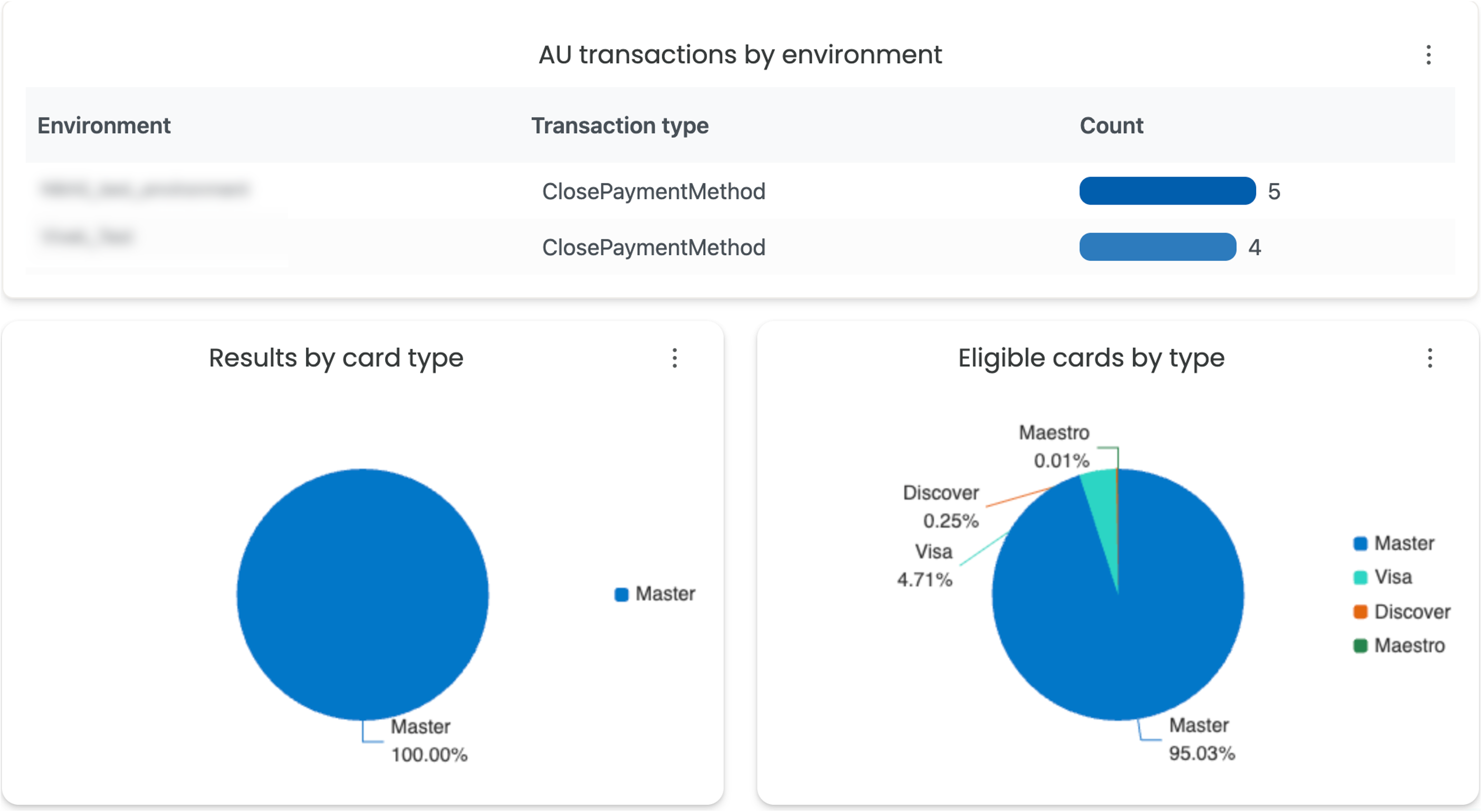

The Lifecycle Management report will also include details on Transactions by Environment, Results by Card Type, and Eligible Cards by Type:

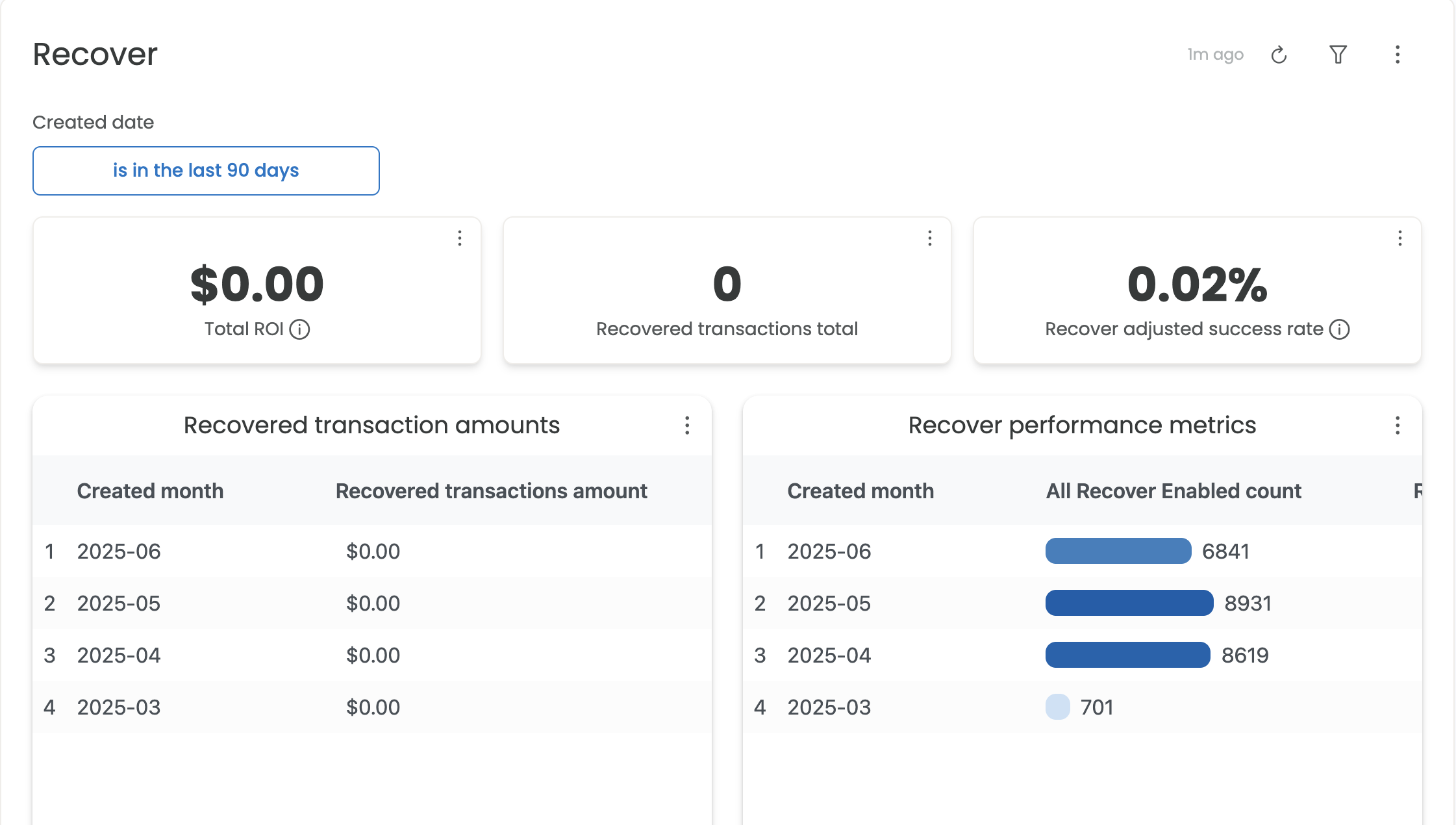

Recover report

The Recover section will show high level Recover performance, as well as a detail list view of Recover attempts. If you are using Recover in Composer, there are additional views specific to Recover usage via Composer.

Recover ROI

The overall total for the chosen time range of Recovered Revenue

Recovered Transactions Total

The overall count for the chosen time range of Recovered Transactions

Recover Adjusted Success Rate

A modified Success Rate, which accounts for Recovery attempts so as to recount multiple failures, or count an initial failure as an ultimate success.

Recovered Transactions Amount:

This high level view will provide the Amount in USD of transactions successfully recovered, as well as the count of transactions successfully recovered.

Recover Performance Metrics:

This view will provide overall performance data of the Recover product for a given environment:

All Recover Enabled Count: The total number of Transactions where Recover was enabled. Recovery does not have to be attempted to be counted here.

Recover Attempted Count: The count of initially failed transactions where Recovery was attempted.

Successfully Recovered Count: The count of initially failed transactions that were attempted to Recover and that Recovery was successful.

Failed Transactions Attempted to Recover: Provides a % view of how often recovery is attempted when the transaction initially fails.

Recovered Rate: The rate at which Recover is attempted and succeeds in recovery.

Recover Success Rate Uplift: The % of uplift added to your overall SR that comes from successful recovery of failed transactions.

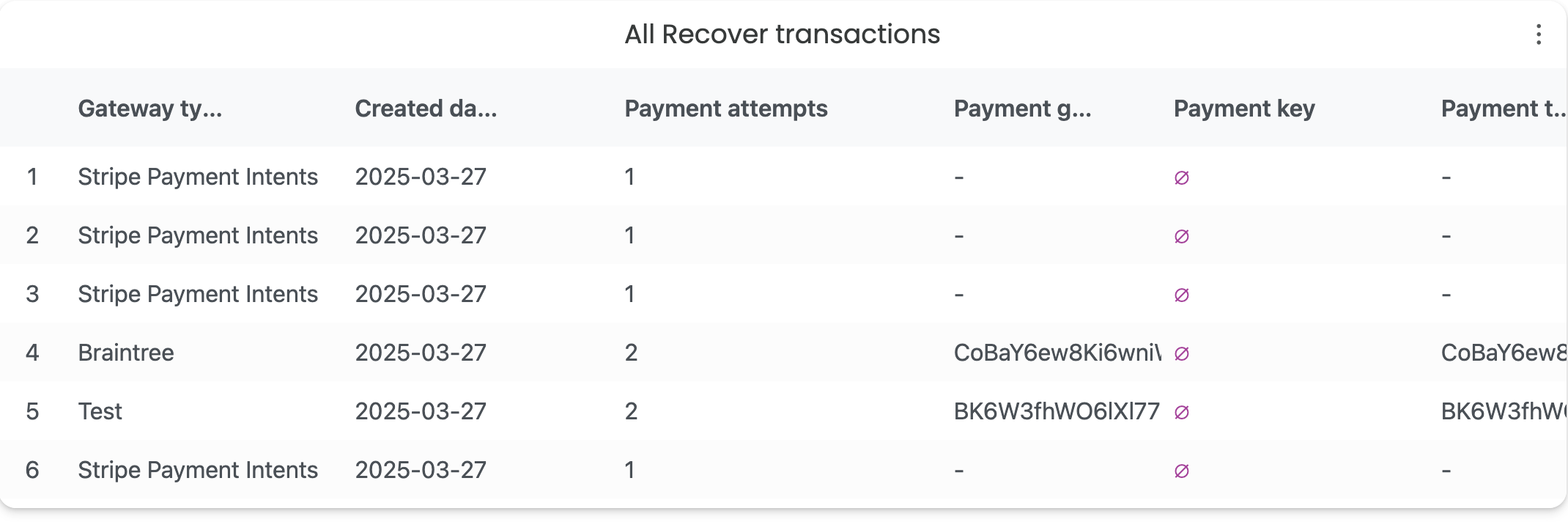

All Recover Transactions

A detailed breakdown of all Recover enabled transactions.

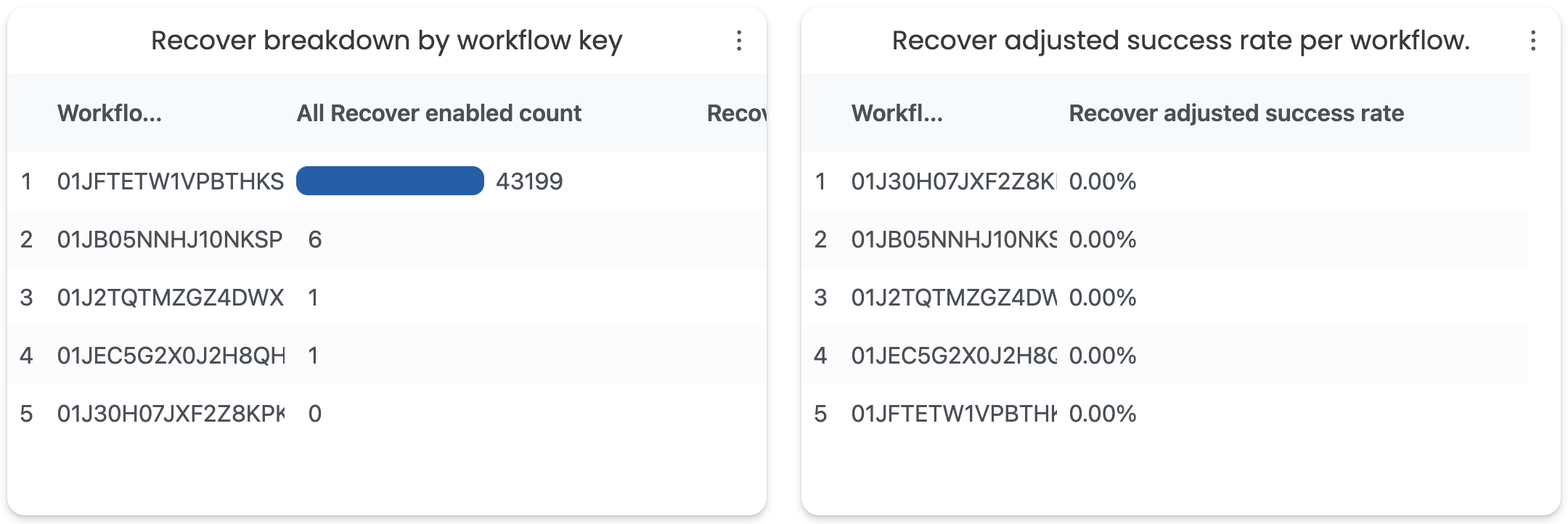

Recover Breakdown by Workflow Key

A Composer Specific view, which shows similar Recover performance metrics, but is broken down by the workflow key in which is was used. Helpful for tracking performance on a workflow by workflow basis.

Recover Adjusted SR by Workflow

Provides an adjusted overall success rate by workflow, ultimately very useful for comparing performance per each workflow.

Standard capabilities

Across reporting, you will find standard capabilities around downloading the data you are viewing.

Downloading CSVs

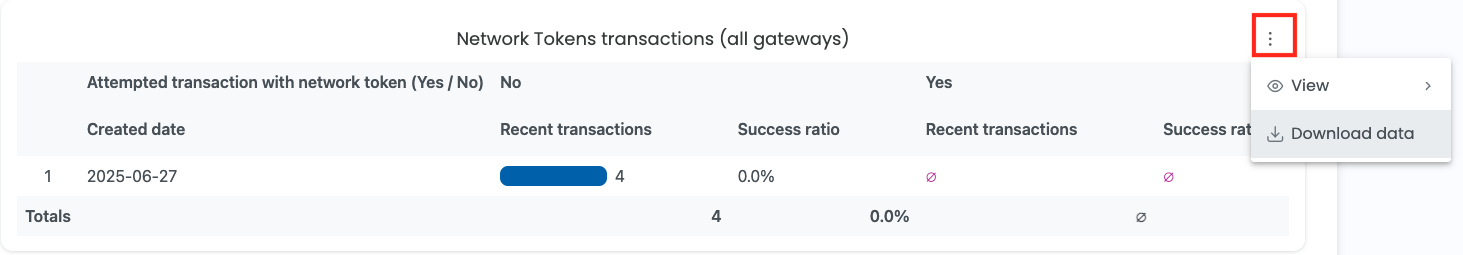

Spreedly allows you to download your data as a CSV for offline analysis. If you are downloading from a table, the data will contain the same headers and return the data as it is displayed, including the filters you have applied. Tables are capped at 500 results. To access the download, use the tile actions and select Download Data.

Downloading a CSV from a table

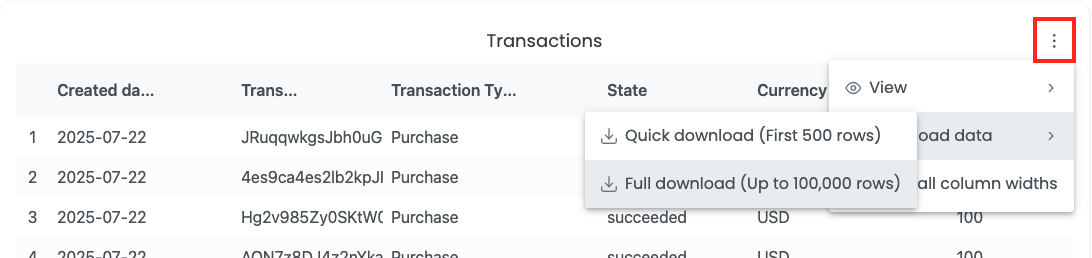

On the Transactions report table and the Lifecycle Management AU transactions table, you have the option to download up to 100,000 results. If you have more than 100,000 transactions, please narrow the filter and download in sets of 100,000. This option can be found under the tile actions, selecting Download Data and then choosing the Full Download option. If you only wish to download the table results, select Quick Download.

Quick and Full download options

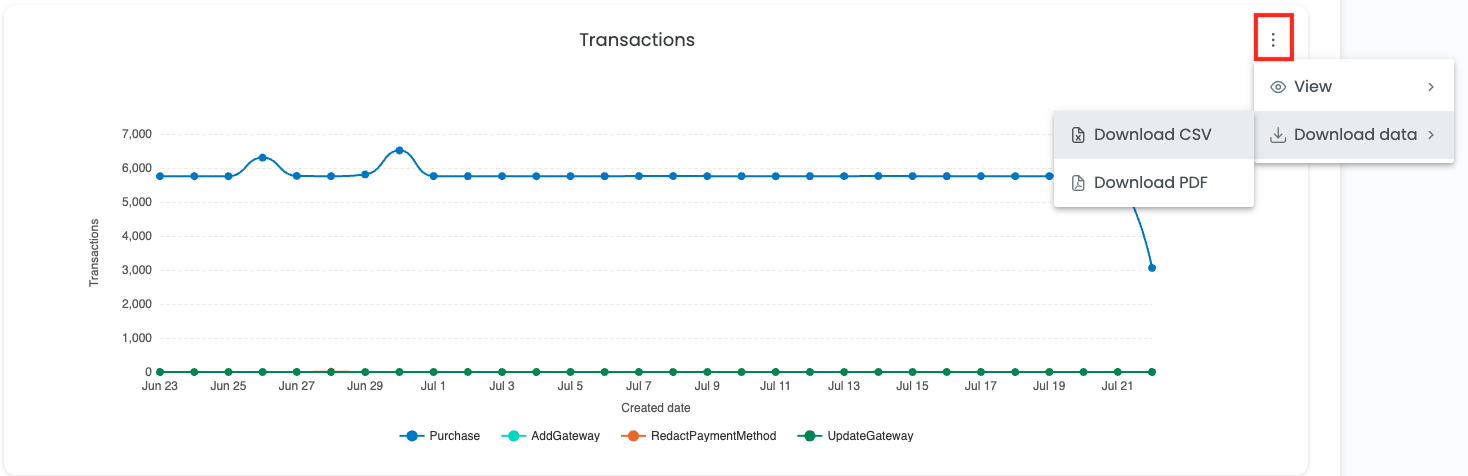

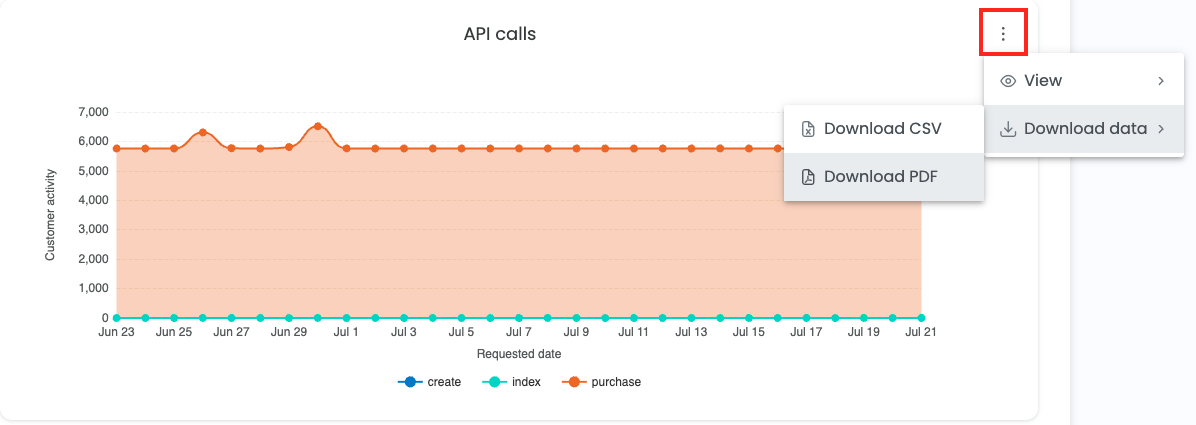

There is also the option to download the data that is creating a chart. In that scenario, use the tile actions and select Download Data then Download CSV.

Downloading data from a chart

Attempting to download a greater volume of available data may result in slowness

Downloading PDFs

On visual charts, there is the option to download as a PDF. To access this feature, use the tile actions menu. Selecting Download Data, and then Download PDF will initiate a download of the chart image as a PDF.

Using tile actions to access the PDF download

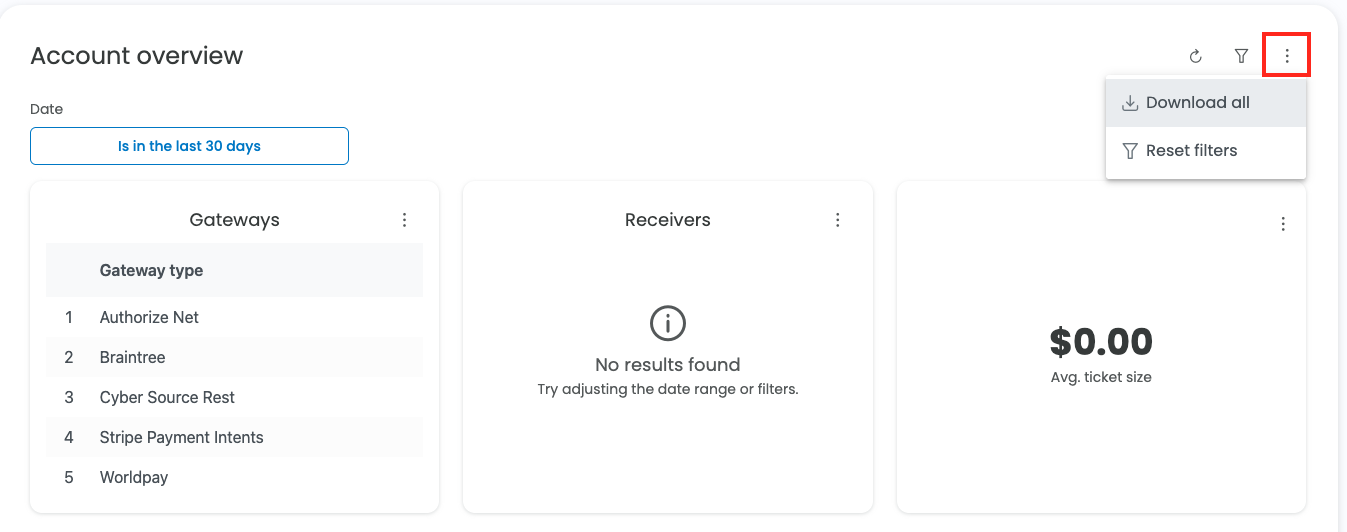

Dashboard Download

If you wish to download the data for a grouping of reports, you can use the dashboard actions and select Download All. This will generate a zip file that combines the PDFs and CSVs belonging to that group.

Downloading a zip file

FAQs

Can I add my own custom time filters?

Customers may use the date filter to choose various filter options.

How up-to-date is this data ?

The average lag time is around 60 minutes from when a transaction occurs and the data is available for analysis. The lag applies to all reports except for data found in Transactions and Gateways in an environment.

Updated 3 days ago